Contractor financing is a crucial resource for construction professionals, offering tailored loans and credit lines to fund project costs, manage cash flow, and mitigate risks. Through options like traditional bank loans, alternative lenders, or peer-to-peer platforms, contractors can access capital for materials, labor, and equipment. A strategic approach involves evaluating funding sources based on project needs and financial health, with robust business plans, accurate projections, and strong credit scores enhancing financing prospects.

“In today’s competitive construction industry, accessing adequate funding is a significant challenge for many contractors. Understanding contractor financing is crucial for business growth and success. This comprehensive guide aims to demystify this process, offering an in-depth look at how contractor financing works, its substantial benefits, and practical tips for navigating the application journey. By exploring these aspects, contractors can unlock access to capital, fuel their projects, and thrive in a dynamic market.”

- Understanding Contractor Financing: A Comprehensive Overview

- How Contractor Financing Works and Its Benefits

- Navigating the Process: Tips for Contractors Seeking Financing

Understanding Contractor Financing: A Comprehensive Overview

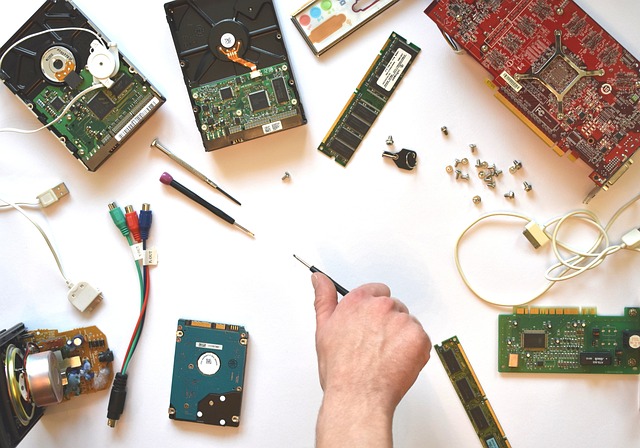

Contractor financing is a crucial aspect of the construction industry, enabling businesses and entrepreneurs to access capital for their projects. It’s a comprehensive financial solution tailored to meet the unique needs of contractors, ensuring they have the resources required to undertake various tasks. This type of financing provides funding for materials, labor, equipment, and other expenses associated with construction projects, catering to both small-scale and large-scale operations.

Understanding contractor financing involves grasping several key elements, including different financing options like loans, lines of credit, and leases. These mechanisms are designed to offer flexibility, allowing contractors to choose the most suitable approach based on their project’s requirements and cash flow patterns. By leveraging these financial tools, contractors can efficiently manage cash flow, mitigate risks, and secure the necessary funds for successful project completion.

How Contractor Financing Works and Its Benefits

Contractor financing is a powerful tool that enables construction professionals to secure funding for their projects, ensuring smooth operations and financial stability. It works by providing a loan or line of credit specifically tailored to cover the costs associated with construction work. This funding can be used for various purposes, including purchasing materials, hiring labor, and managing overheads during the project’s execution. The process typically involves applying to a financial institution or lender, who assesses the contractor’s reputation, past performance, and project details before offering a suitable financing package.

The benefits of contractor financing are manifold. It offers flexibility in terms of repayment structures, allowing contractors to align loan terms with their cash flow patterns. This funding option can significantly reduce the financial strain on contractors, enabling them to focus on delivering quality projects without the burden of immediate cash flow constraints. Additionally, it provides a safety net, ensuring that projects stay on track even if unforeseen challenges or delays arise, ultimately contributing to successful project outcomes.

Navigating the Process: Tips for Contractors Seeking Financing

Navigating the process of securing contractor financing can seem daunting, but with a strategic approach, it becomes an achievable goal. First, contractors should thoroughly research and understand their funding options. This involves exploring traditional bank loans, alternative lenders, government grants, or even peer-to-peer financing platforms. Each option has its advantages and considerations, so evaluating them based on project requirements and personal financial health is crucial.

Next, preparing a comprehensive business plan and financial projections is essential. Contractors should demonstrate their ability to manage cash flow, execute projects profitably, and repay loans. Clear documentation of past projects, client references, and a solid understanding of the market trends will strengthen their application. Additionally, maintaining excellent credit scores can significantly improve access to contractor financing, as lenders often prefer borrowers with strong financial backgrounds.

Contractor financing is a powerful tool that can unlock opportunities for growth and success in the construction industry. By understanding how it works, leveraging its benefits, and navigating the process effectively, contractors can access the capital they need to take on larger projects, expand their businesses, and ultimately thrive. Embracing contractor financing is a strategic move that can lead to a prosperous future for both contractors and the projects they bring to life.